Topics

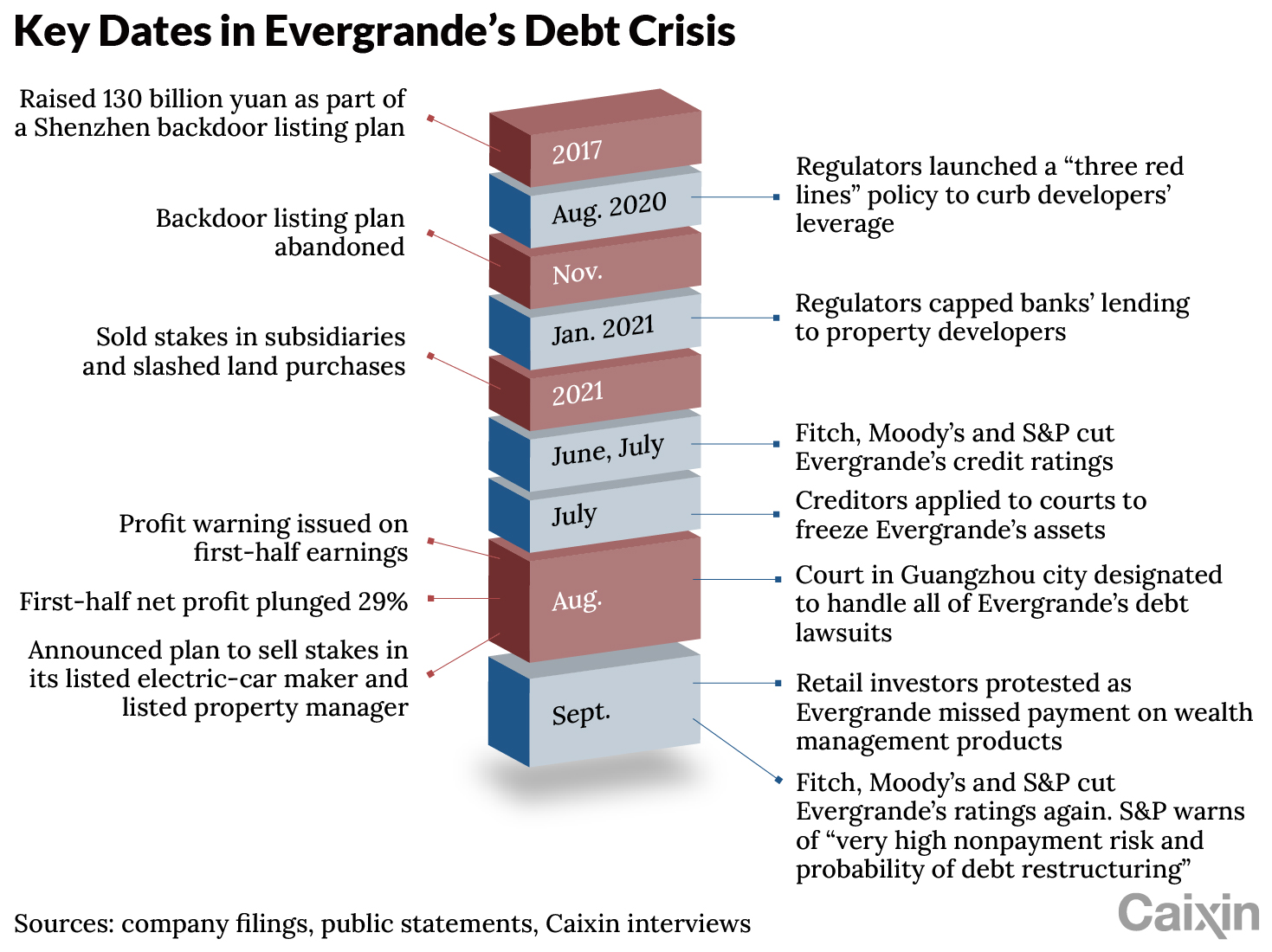

Heavily indebted China Evergrande Group, one of the country’s largest property developers, is suffering a liquidity crisis after years of running a highly leveraged business. The company’s troubles have already started to reverberate through China’s economy and markets around the world.

In Depth: How Evergrande’s Founder Played the Capital Markets

Hui Ka Yan had a knack for creating hype that drove the debt-ridden developer to a stratospheric valuation, allowing it to borrow ever larger amounts

Analysis: Why China Is Moving to Shore Up Insurance Giants

Special sovereign bonds could be used for the first time to bolster insurers’ capital as solvency pressure builds

Luxury Unit Tied to Evergrande Founder’s Family Fetches $7.3 Million at Auction

Court-ordered auction underscores lingering fallout from developer’s collapse as supplier disputes mount

CX Daily: How Gutter Oil Became a Prized Fuel for International Airlines

Used cooking oil, once a food safety liability, is now a strategic asset in the global race to find a cleaner, sustainable aviation fuel

PAG, State Firm Eye Evergrande’s Property Management Business

The Hong Kong-based private equity firm and Guangdong Provincial Tourism have contacted the collapsed developer’s liquidators over a purchase that is seen as crucial for offshore creditors

Former Shanghai Electric Chair Gets Suspended Death Sentence in Graft Case

Zheng Jianhua’s conviction follows a sprawling corruption scandal tied to fake trades and a failed Evergrande bet

China’s Property Slump Knocks Half of Top Developers off Key Ranking

Fifty-three companies remained in the top 100 sales list from 2021 to 2025 as the 100 billion yuan club shrank to just 10 members, a new report says

Shanghai Advances Risk Resolution for Troubled Insurer

State-backed partnership is expected to set up a company to take over Shanghai Life’s assets and liabilities, sources say

Exclusive: Suning’s $28 Billion Restructuring Plan Tests China’s Approach to Corporate Failure

Most debts will be converted into trust shares, with founder Zhang Jindong retaining limited control as creditors await uncertain recoveries

Elusive Billionaire Draws Spotlight After Tragedy at Hong Kong Luxury Mansion

Zhang Songqiao rose from selling cheap watches to owning London skyscrapers and Hong Kong’s priciest homes. Now, a tragedy at his Victoria Peak estate has shattered decades of silence.

Business Brief (Oct. 13): Beijing Decries U.S. ‘Double Standards’ on Trade Controls

China to levy special port fees on U.S. ships, Dutch government orders asset freeze at Chinese-owned Nexperia

Commentary: To Globalize the Yuan, China Must Fix Its Bond Market

Beijing has made strides in building the world’s second-largest debt market, but deep-seated flaws and low foreign ownership prevent the yuan from achieving its potential as a true reserve currency

Hong Kong Court Puts Evergrande Liquidators in Charge of Founder Hui’s Fortune

Liquidators granted sweeping powers to hunt Hui Ka Yan’s assets, including offshore trusts and shell firms

Exclusive: Citic Bank’s International Department Chief Becomes Unreachable

Zhang Lin’s situation may involve a close relative and is likely linked to Evergrande, sources say

Business Brief (Aug. 26): Chinese Stocks Surge, Yuan Appreciates

Shanghai eases property restrictions to boost market, China outlines major expansion of its national carbon trading

CX Daily: China’s Stock Market Roars Back to Life — But Can It Outrun Economic Gravity?

China’s top securities regulator reshuffles key departmental heads. Cambricon inches closer to becoming the country’s priciest stock.